Structuring assets & liabilities for wealth creation.

Sourcing property, negotiating and due diligence.

Maximising income & growth; minimising debt & tax.

Protecting and navigating the generational wealth transfer.

How much wealth would you like to create? A $3m, $5m or $10m+ property portfolio. You make a choice; we make it happen.

WHO ARE WE?

P16 is the leading full-service property consultancy in Australia.

We are a specialist SMSF and interstate property buyers.

WHAT DOES P16 DO?

P16 is the one stop shop for property wealth advice, coaching, suburb research and Buyers Agent services.

P16 accelerates wealth creation and builds you a portfolio fast.

HOW CAN P16 HELP YOU ?

HOW DOES P16 WORK?

P16 Investing

provides advice, undertakes market research and facilitates an end-to-end buying process to build you a portfolio.

P16 Coaching

provides help with planning, strategizing, market research and one-on-one coaching while you’re buying.

P16 Tutorials

is a property investing course that teaches the “Where”, “What” and “How” to buy to build a portfolio.

WHAT DOES P16 STAND FOR?

The P’ stands for “Property” while ‘16’ stands for the number of hours students typically spend with us to acquire knowledge (P16 Tutorials) and develop practical skills (P16 Coaching) in investing.

It also signifies the “Power” of learnings from just 16 hours of targeted teachings and coaching.

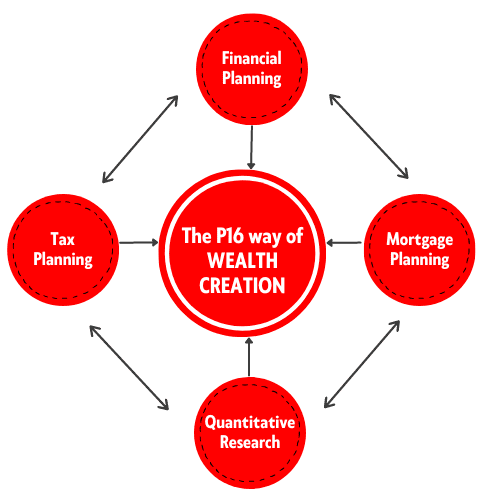

THE P16 WAY TO WEALTH CREATION

At P16, we are much more than a regular Buyers Agent that buys you a property, we are a team of professionals that builds you wealth.

P16 takes a wholistic approach to wealth creation. We build you a strong wealth foundation on the pillars of financial plan, tax saving, mortgage optimisation and investment research.

P16 is the only property consultancy that follows the complete financial planning process of wealth creation.

When you work with P16, you have a financial planner, a tax advisor, a mortgage broker, a suburb researcher and a buyers agent in your team working for you.

Whether you are in your 20’s or 50’s, whether your family annual income is $100,000 or $1,000,000, our 3-step process has proven to deliver results.

Step 1. Financial planning and strategy formulation.

Step 2. Market research and suburb selection.

Step 3. Buyers’ Agent services (negotiation and due deligence)

THE P16 WAY TO WEALTH STRATEGY

Our aim is to help you build a low-risk portfolio, pay off your mortgages faster, save tax and improve your personal finance and lifestyle.We follow the financial planning industry principles and processes - P16 Strategy Team.

P16 way is the formulation of 6 sub-strategies.

Your Tax Strategy

Your Mortgage Strategy

Your Property Ownership Strategy

Your Investment Strategy

Your Risk Strategy

Your Wealth Transfer Strategy

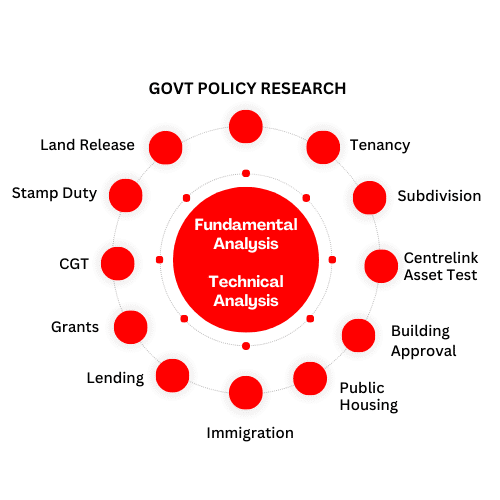

THE P16 WAY TO RESEARCH

Fundamental Analysis

Quite often markets incorrectly price a suburb/city in the short run and the “correct” price is eventually reached. Higher profits can be made in the long run by purchasing a property in the “wrongly” priced suburb/city and then waiting for the market to recognise its “mistake” and reprice the suburb/city.

P16 inhouse research team works with the Commonwealth and State government departments such as Treasuries and Housing departments and their agencies such as the ABS, ASIC and APRA, analyses their policy papers, pieces of legislation, data and reports, while assessing their impacts on the housing markets.

Policies and actual Data collected on first, demand side, such as population growth, home buyers’ grants, building grants, interest rate policy, taxes etc and second, supply side, such as land release, building approval, construction activity, planning policies etc. forms part of the fundamental analysis.

Fundamental analysis that looks at the leading and lagging economic and housing market indicators (in the context of broader govt policies and legislation), is key to forecasting medium to long-term growth and identifying undervalued property markets.

Technical Analysis

On the ground property market demand and supply real-time data, trends and price levels confirm sentiment change. Recognisable price patterns may be found due to investors emotional responses to price movements which provides clue to short term market price movements.

Technical analysis is based on property market data analysis (such as days in the market, average discounting, property search interest, % stock level, rental vacancies, rental yields, etc.) that provide a picture of the current market demand and supply and the trend.

Our approach is to analyse data and trends provided by the leading third-party analyst’s and researchers (such as HtAG, DSRdata, Corelogic, Hotspotting, SQM Data, etc.). P16 has a “research the researchers” philosophy to technical analysis.

Technical analysis is key to forecasting a short-term growth and identifying suburbs that are on the cusp of a growth spurt.

We first look for long term growth markets (using Fundamental Analysis) before narrowing them down to suburbs that would grow immediately (using Technical Analysis).

THE P16 WAY TO ACQUISITION

Our aim is to acquire properties that are below the market value

and sustains your portfolio – P16 Acquisition team.

Growth

Our primary concern is the long-term growth in your portfolio. ‘Growth’ is a ‘higher quality’ return as compared to other returns such as cash flow, income and tax benefits.

Potential

We buy properties that have potential for one or more of the following: subdivision, renovation, extensions, and additions. This allows you to improve future returns.

Balance

We choose properties with the right balance of rental income and tax savings that favours you to achieve your wealth goals and build a portfolio. Positive cashflow can prove important when your own income is less likely to increase in the future.

Diversification

All cities have their own growth cycles. We help you not just buy properties in your own city but also in other parts of Australia. Diversification reduces risks, costs and improves overall returns.

Due Diligence

We physically inspect all the properties that we buy, to ensure they are in the right pockets. We also engage qualified structural and pest inspectors.

Negotiation

We help you negotiate a favourable buying contract to protect your interests with an aim to buy at a price below the property’s intrinsic value.

OUR CLIENTS EXPERIENCES

MICHAEL SIMPSON

🌟🌟🌟🌟🌟

SUMAN PUROHIT

🌟🌟🌟🌟🌟

Mr CHUONG

🌟🌟🌟🌟🌟

DOUG PETERS

🌟🌟🌟🌟🌟

JAMES O’REILY

🌟🌟🌟🌟🌟

SARAH ROSE

🌟🌟🌟🌟🌟

EM CLARKE

🌟🌟🌟🌟🌟

MANINDER SIDHU & SANDEEP KAUR

🌟🌟🌟🌟🌟

JHYE WILLIAM

🌟🌟🌟🌟🌟

BILAL ALI AHMED

🌟🌟🌟🌟🌟